Trade Terms FOB – Free On Board

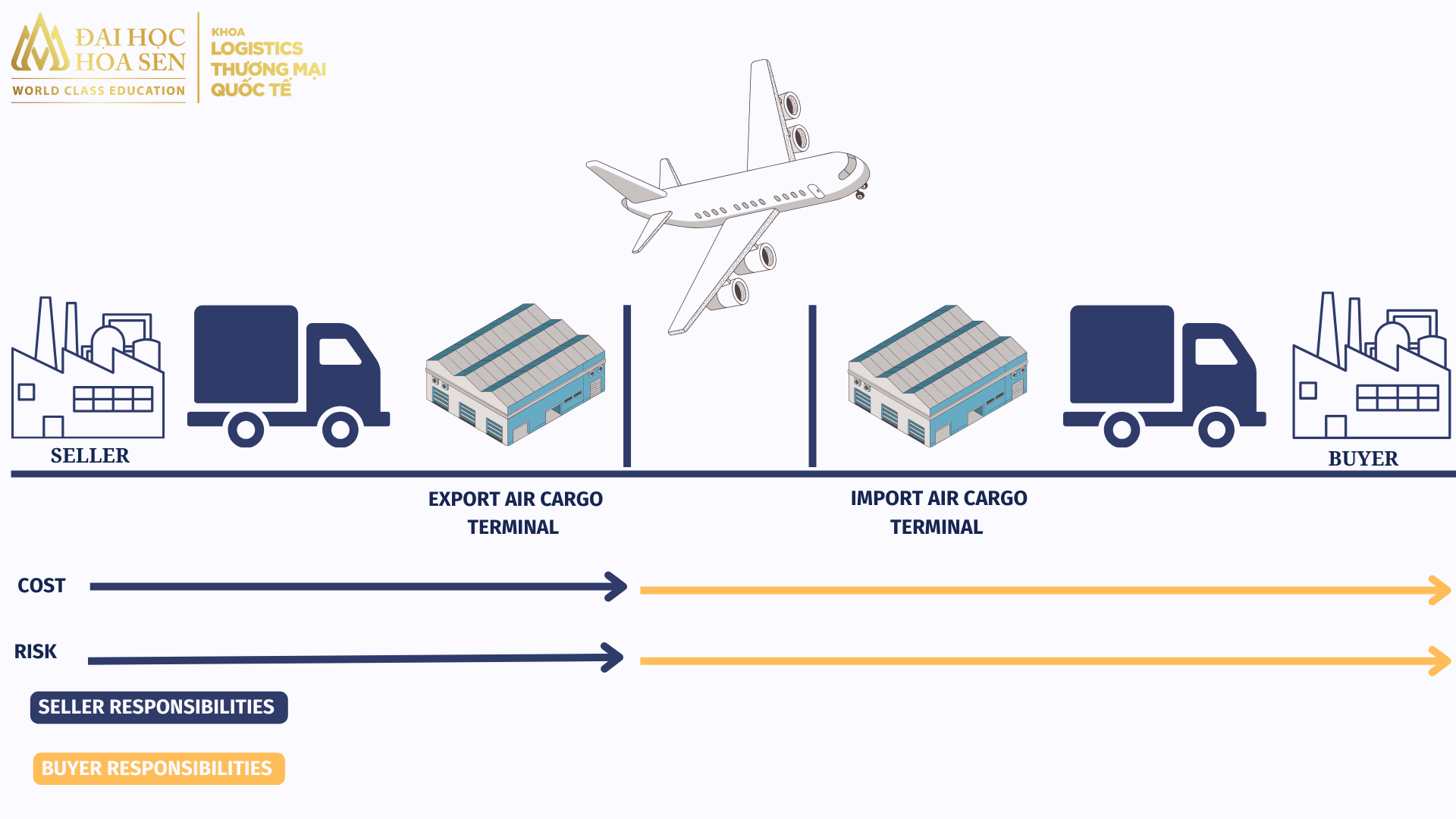

FOB Trade Terms are one of the most widely used delivery terms in international trade. In FOB air transport, the seller fulfills its obligation to deliver the goods to the buyer when the goods are safely placed on the deck of the aircraft designated by the buyer at the departure airport as well as fulfills certain cost obligations at the airport. export port.

And of course, the responsibilities of the seller and buyer do not stop there when the import and export of goods by air under FOB trade terms takes place. Let’s join the Faculty of Logistics and International Trade to decode FOB trade conditions in air freight through today’s article.

Responsibilities of the seller (shipper, exporter)

When exporting goods by air under FOB delivery terms, the seller is responsible for:

Unloading goods from inland transport vehicles

Transporting goods to the export airport cargo terminal

Do export customs clearance and pay export taxes (if any).

Regarding cost responsibility, the seller will pay local charges at the port of shipment. Some local aviation charges exported from Vietnam include: FSC (Fuel surcharge): Fuel/gasoline surcharge; SSC (Security Surcharge): Security surcharge; X-Ray: Scanner surcharge; Bill/Doc/AWB: Bill of lading fee; AMS (Automated Manifest System)/ENS (Entry Summary Declaration) /AFR (Advance Filing Rule): Fee for transferring customs data to the US/Europe/Japan

Responsibilities of the buyer (consignee, importer)

According to the provisions of FOB conditions, the buyer is responsible for:

Pay for the goods to the seller, sign a transport contract and pay the main transport fee. Here is the air freight from the export airport to the import airport. Besides, the buyer will pay local charges at the port of import. Some basic local charges for imported goods include: cargo handling fee; Delivery Order Fee

In addition to the above mentioned cost responsibility, the buyer shall:

Unload goods from inland transport vehicles at the buyer’s warehouse and enter the warehouse

At the same time, carry out import customs clearance procedures, pay import tax and value added tax (if any).

Note about risk transfer

Risk from the seller transfers to the buyer when the seller completes the delivery of the goods onto the aircraft designated by the buyer at a port in the seller’s country according to the provisions of the contract.

Illustrative example

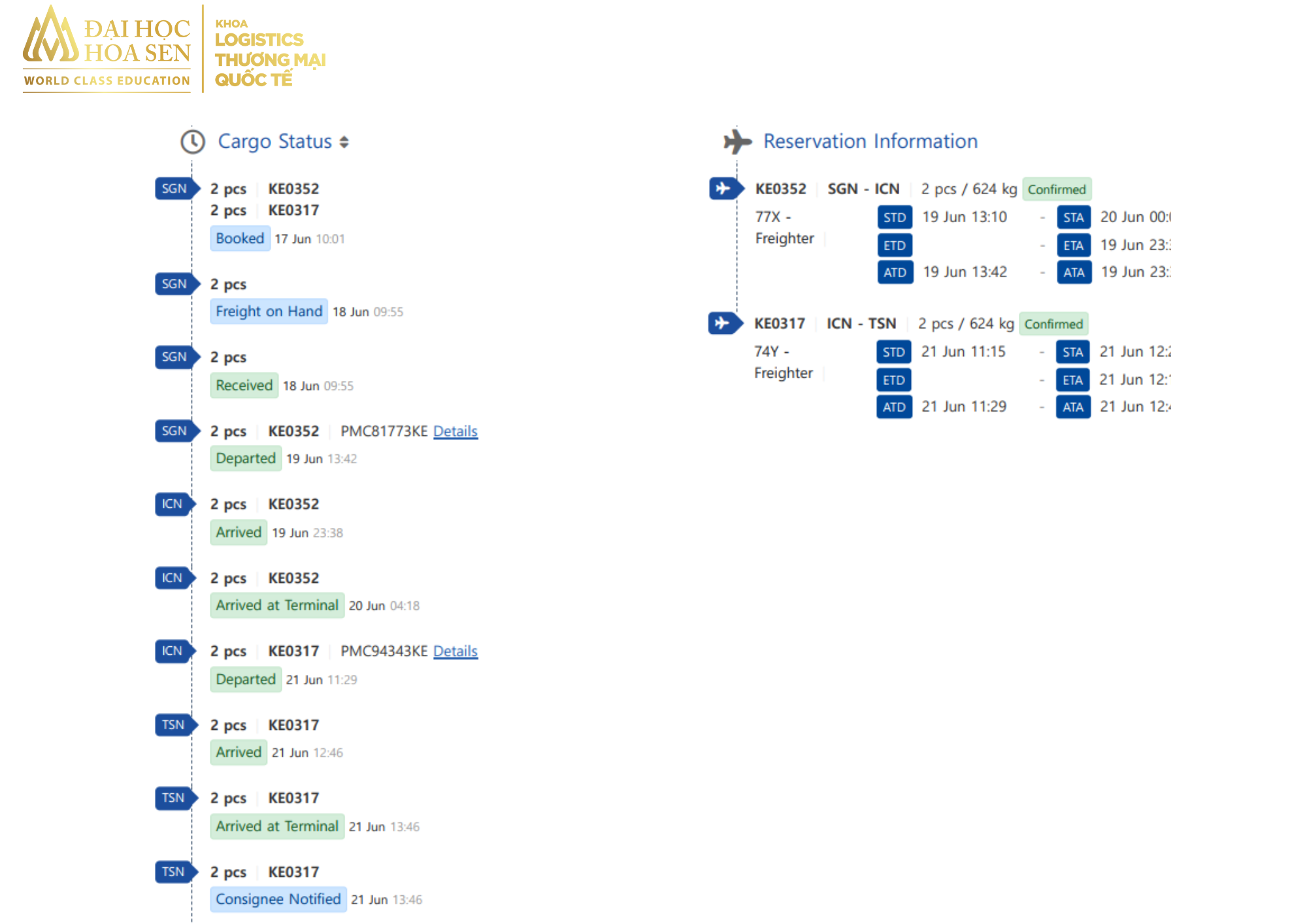

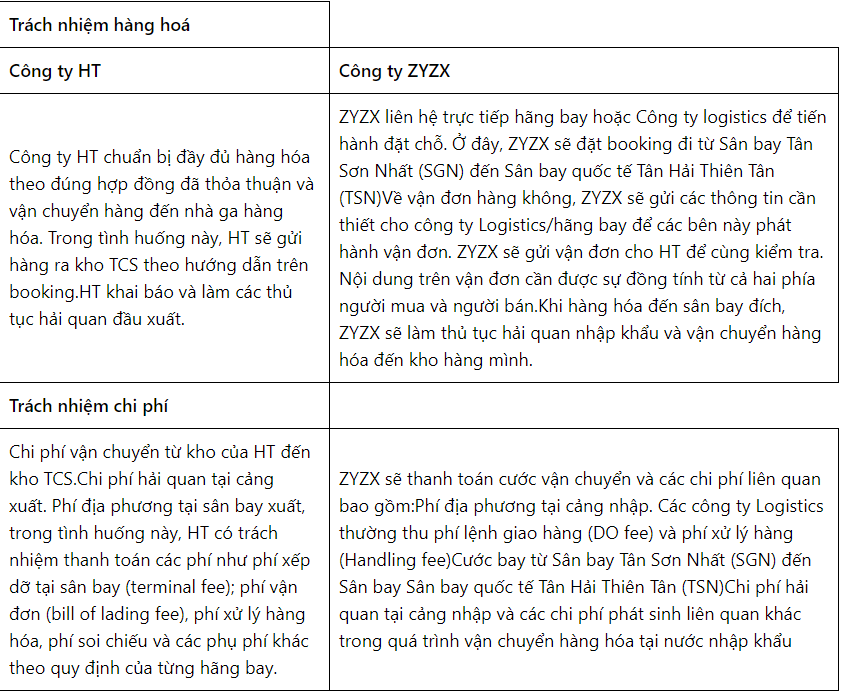

HT Company exports a shipment of 2 wooden bales of Silver plated copper wire to Tianjin Cargo Airport under FOB terms for ZYZX Company. Specific product details: 1 package with dimensions 1095867 cm – product weight: 448 kgs and 1 package with dimensions 89 * 58 * 66 CM – product weight: 176 kgs.

Below is the allocation of goods responsibilities and costs when HT Company exports goods to ZYZX Company by air under FOB terms.

Regarding the responsibility to buy insurance, when the seller and buyer sign a sales contract under CIP terms, the seller must have the obligation to buy insurance for the goods so that the buyer can benefit.